Iowa Standard Deduction 2025 - Iowa Standard Deduction 2025 Jayme Melisse, The standard deduction for 2025 will increase by $400 to $15,000 for single filers and married filing separately and to $30,000 for married couples filing jointly. Standard Tax Deduction 2025 Married Jointly Under 80c Sonia Paige, Iowa’s 2025 withholding methods are the first to use a flat tax rate of 3.8%, but also make changes to the standard deduction depending on which version of the state’s.

Iowa Standard Deduction 2025 Jayme Melisse, The standard deduction for 2025 will increase by $400 to $15,000 for single filers and married filing separately and to $30,000 for married couples filing jointly.

Standard Tax Deductions For 2025 Idalia Gaylene, This means that taxpayers will be allowed the same:

California Tax Standard Deduction 2025 Robert Kerr, Tax brackets and standard deductions have increased for tax year 2025.

Iowa Standard Deduction 2025. Iowa provides a standard personal exemption tax credit of $ 40.00 in 2025 per qualifying filer and $ 40.00 per qualifying dependent (s), this is used to reduced the amount of iowa state income that is due in 2025. For 2025, the standard deduction will rise by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household.

Standard Home Office Deduction 2025 Caye Maegan, Most recently, the governor signed a law in may that sped up previous income tax cuts, decreasing the state’s individual income tax to a 3.8% flat tax rate beginning in 2025.

2025 New Standard Deduction Idell Barbette, Iowa provides a standard personal exemption tax credit of $ 40.00 in 2025 per qualifying filer and $ 40.00 per qualifying dependent (s), this is used to reduced the amount of iowa state income.

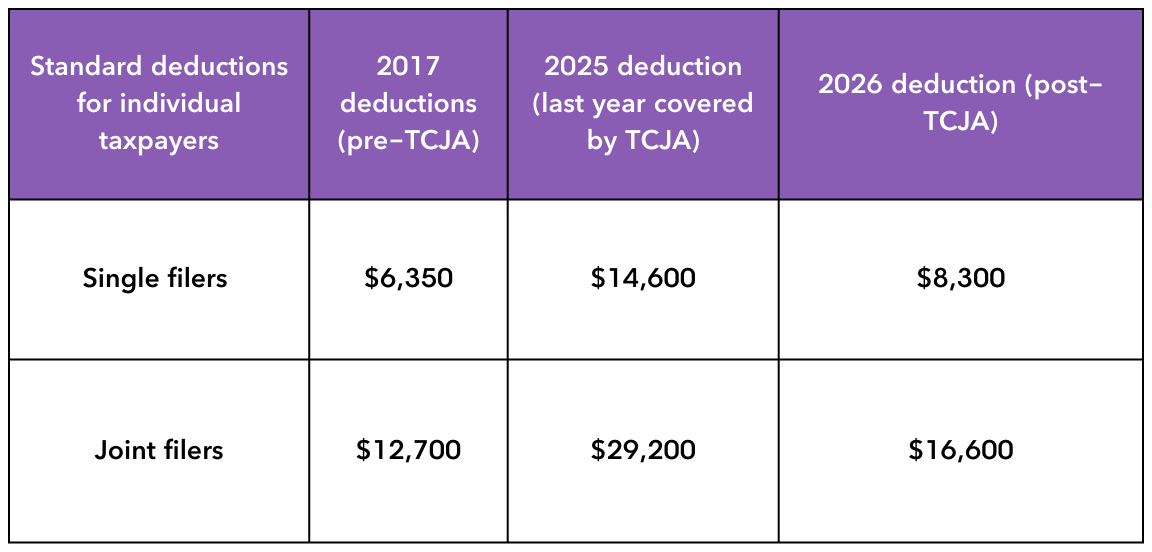

2025 Tax Policy Crossroads What Will Happen When the TCJA Expires, For married taxpayers filing jointly.

Iowa Standard Deduction 2025 Jayme Melisse, Standard deduction for 2025 (taxes you file in 2025) single.

Standard Tax Deduction For 2025 Felicity Blake, This means that taxpayers will be allowed the same:

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Since the enactment of iowa senate file 2442 in may, 2025, iowa law provides for a flat tax rate of 3.8 percent for all levels of taxable individual income beginning with tax year 2025. On may 1, 2025, iowa governor kim reynolds approved sf 2442, which, effective january 1, 2025, collapses the personal income tax brackets from three to a single tax rate of 3.8%.